Support Hunger Relief and Reduce State Taxes Through Mississippi House Bill 1723

Mississippi HB1723 offers business taxpayers a powerful way to support hunger relief while directly reducing state tax liability. Through this program, cash contributions to Feeding the Gulf Coast, or one of the state’s other Food Bank Charitable Organizations, qualify for a dollar-for-dollar state tax credit.

This state tax credit directly reduces taxes owed; it is not a deduction. Donations to the food bank may be applied against Mississippi income tax, insurance premium tax, insurance premium retaliatory tax, or ad valorem tax. By participating, businesses ensure these dollars stay in the local community to support children, families, seniors, and veterans facing hunger across South Mississippi.

HB1723 creates a meaningful opportunity for Mississippi businesses

to align community impact with smart financial stewardship.

To learn more and submit an application for allocation of credit, visit the

Mississippi Department of Revenue Food Bank Charitable Organization credit page.

Application

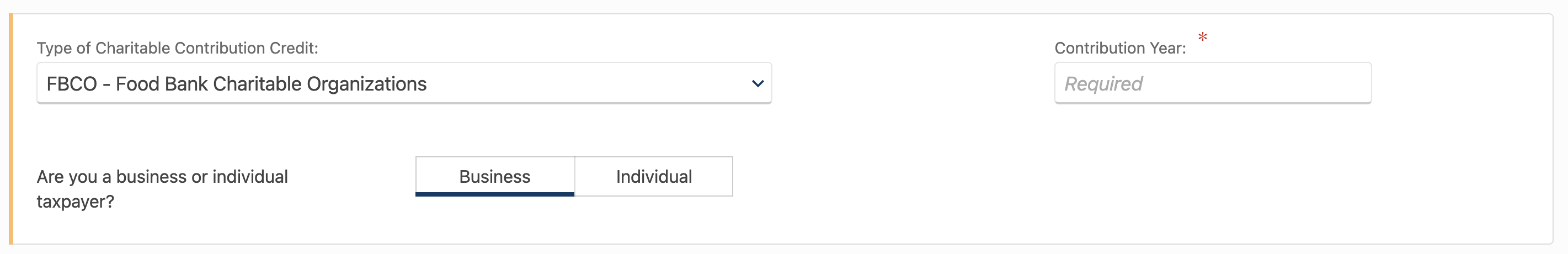

Note: Make sure to select FBCO from dropdown menu (see below)

Consulting with a tax professional is encouraged to help optimize tax strategy and maximize benefits available through HB1723.

Have questions or want to discuss making a contribution? Contact Cyndy Baggett, Vice President of Development & Marketing, at (228) 896-6979 x. 130